Attain Your Desires with the Support of Loan Service Professionals

Attain Your Desires with the Support of Loan Service Professionals

Blog Article

Pick From a Variety of Loan Providers for Personalized Financial Aid

When it comes to seeking financial aid, the variety of funding solutions readily available can be frustrating yet important in securing tailored assistance. By checking out these varied loan services, individuals can unlock opportunities for tailored financial help that straighten with their goals and scenarios.

Loan Choices for Financial Debt Consolidation

When considering finance choices for financial obligation loan consolidation, individuals have a number of methods to explore (mca funders). One usual option is a personal lending, which enables debtors to integrate multiple debts right into one financing with a taken care of regular monthly settlement and rate of interest rate.

An additional choice is a home equity funding or a home equity line of credit scores (HELOC), which utilizes the consumer's home as collateral. These fundings typically have reduced interest prices contrasted to individual lendings yet come with the threat of shedding the home if repayments are not made. Balance transfer charge card are also a prominent selection for financial debt loan consolidation, providing an introductory duration with low or 0% rate of interest prices on moved balances. It is important to thoroughly take into consideration the terms and charges associated with each alternative prior to deciding on the most appropriate car loan for financial debt combination.

Personal Finances for Large Purchases

Encouraging on monetary decisions for substantial purchases usually involves taking into consideration the alternative of making use of personal car loans. Loan Service (mca loan companies). When facing considerable expenditures such as buying a brand-new lorry, moneying a home restoration job, or covering unexpected medical expenses, personal loans can give the necessary monetary support. Personal lendings for big acquisitions use people the versatility to obtain a certain quantity of cash and repay it in taken care of installments over a fixed duration, usually varying from one to seven years

Among the vital benefits of individual lendings for significant acquisitions is the ability to access a round figure of cash upfront, enabling people to make the preferred acquisition immediately. In addition, personal car loans typically include affordable rate of interest rates based upon the debtor's creditworthiness, making them a cost-efficient funding alternative for those with good credit report. Prior to selecting an individual finance for a big purchase, it is important to analyze the conditions supplied by different loan providers to safeguard one of the most favorable bargain that straightens with your financial goals and repayment abilities.

Reserve and Payday Loans

:max_bytes(150000):strip_icc()/6-benefits-of-using-a-credit-union.aspx_final-6e501699186e429ab6458d9e36ebe4a1.jpg)

When encountering a monetary emergency, individuals should explore different options such as working out layaway plan with creditors, seeking aid from neighborhood charities or government programs, or loaning from family and friends prior to considering payday lendings. Developing an emergency fund gradually can additionally assist minimize the demand for high-cost loaning in the future.

Specialized Car Loans for Specific Demands

When looking for economic assistance customized to special scenarios, people might check out specific lending choices created to address specific needs effectively. These customized loans provide to various situations that need customized financial solutions beyond conventional offerings. As an example, clinical lendings are tailored to cover healthcare costs not completely click covered by insurance coverage, supplying people with the necessary funds for therapies, surgical procedures, or clinical emergency situations. Likewise, student car loans use certain terms and benefits for educational objectives, assisting students finance their studies and associated expenses without overwhelming financial worry.

Moreover, home restoration loans are made for home owners looking to update their properties, providing practical settlement plans and affordable rates of interest for redesigning jobs. In addition, bank loan accommodate business owners seeking resources to start or broaden their endeavors, with specialized terms that align with the distinct requirements of company operations. By discovering these specialized funding choices, individuals can discover tailored financial remedies that meet their specific demands, supplying them with the required assistance to accomplish their objectives effectively.

Online Lenders for Quick Approval

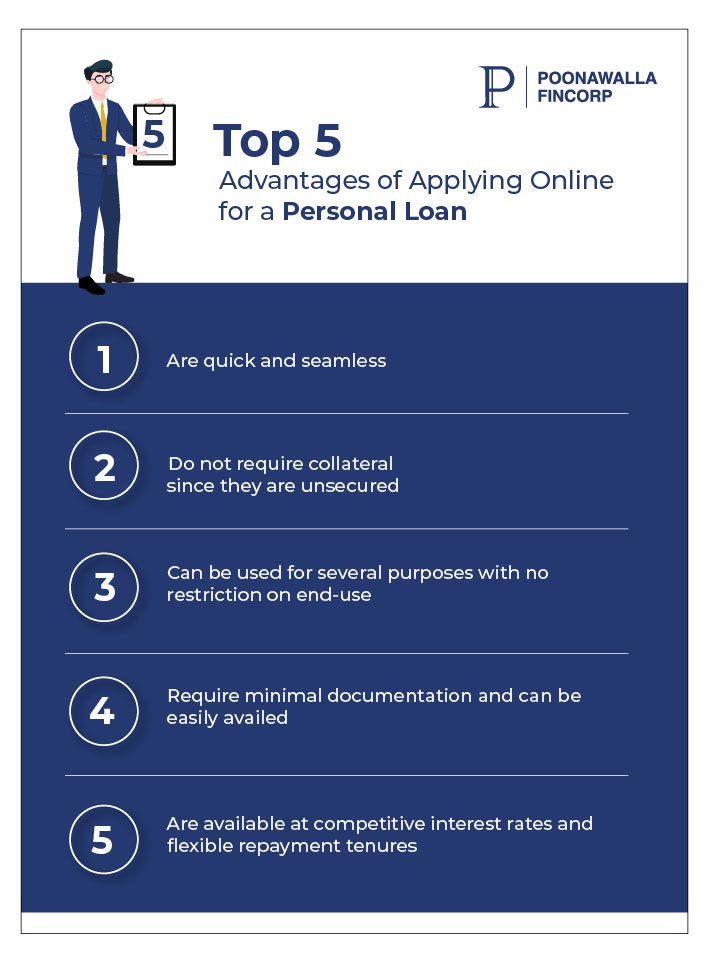

For expedited finance authorization processes, people can turn to online lenders that supply swift and convenient financial services. On-line lending institutions have actually revolutionized the loaning experience by improving the application procedure and supplying fast approvals, occasionally within minutes. These lending institutions commonly use a wide variety of funding options, consisting of individual loans, payday financings, installation lendings, and lines of credit scores, dealing with varied economic needs.

One of the crucial advantages of on the internet loan providers is the rate at which they can refine lending applications. By leveraging technology, these loan providers can assess a person's credit reliability promptly and make financing choices quickly. This effectiveness is specifically advantageous for those that need prompt accessibility to funds for emergencies or time-sensitive expenses.

Additionally, online lending institutions typically have less rigorous qualification standards compared to conventional banks, making it less complicated for people with differing debt accounts to safeguard a funding. This availability, integrated with the fast approval procedure, makes on-line loan providers a popular choice for many seeking quick and problem-free monetary support.

Conclusion

Finally, individuals have a variety of car loan choices offered to address their financial needs. From financial obligation combination to reserve and specific fundings, there are services tailored to details scenarios. On the internet loan providers additionally use quick approval for those seeking immediate financial support. It is necessary for individuals to carefully consider their choices and select the funding solution that ideal fits their requirements.

Report this page